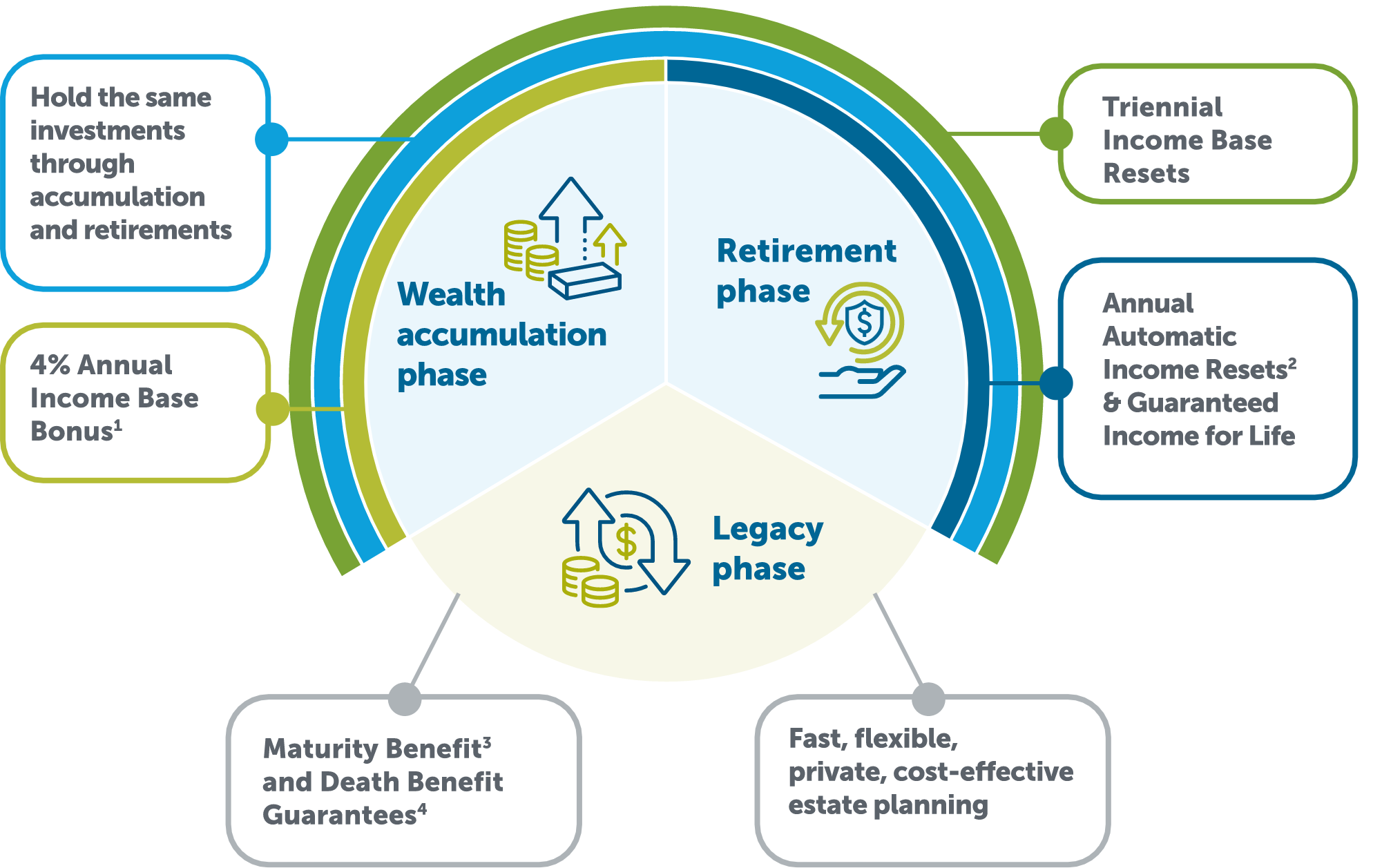

Whether your life’s goal is building wealth, having income for retirement or protecting your loved ones, Empire Life segregated funds have the choice and guarantees you need to help meet your financial goals for today and in the future.

1 The Income Base Bonus is credited in years that there are no withdrawals from Class Plus 3.0 for the first 20 calendar years you own Class Plus 3.0. It is a notional amount and has no cash value.

2 Increasing Lifetime Withdrawal Amount (LWA) rates between ages 55 to 80, and level thereafter. Calculated based on the current Income Base and the applicable LWA percentage that corresponds to the Annuitant’s age as of December 31st of the following calendar year.

3 Adjusted proportionally for withdrawals.

4Death Benefit Guarantee automatically resets every 3 years to lock-in any market gains. Up to and including Annuitant’s 80th birthday. Adjusted proportionally for withdrawals.

Build your retirement nest egg from a range of investment options such as Emblem Portfolios for instant diversification and several standalone funds that offer up to 80% equity exposure.

Here is where you get to enjoy the fruits of your labour, and with Class Plus 3.0 you can rest easy knowing that your income is guaranteed for as long as you live.

Class Plus 3.0 enables you to protect your initial investment in the event of your untimely death, by providing quick, cost-effective and private distribution of funds. You can also choose to continue the contract by naming a Successor Annuitant.

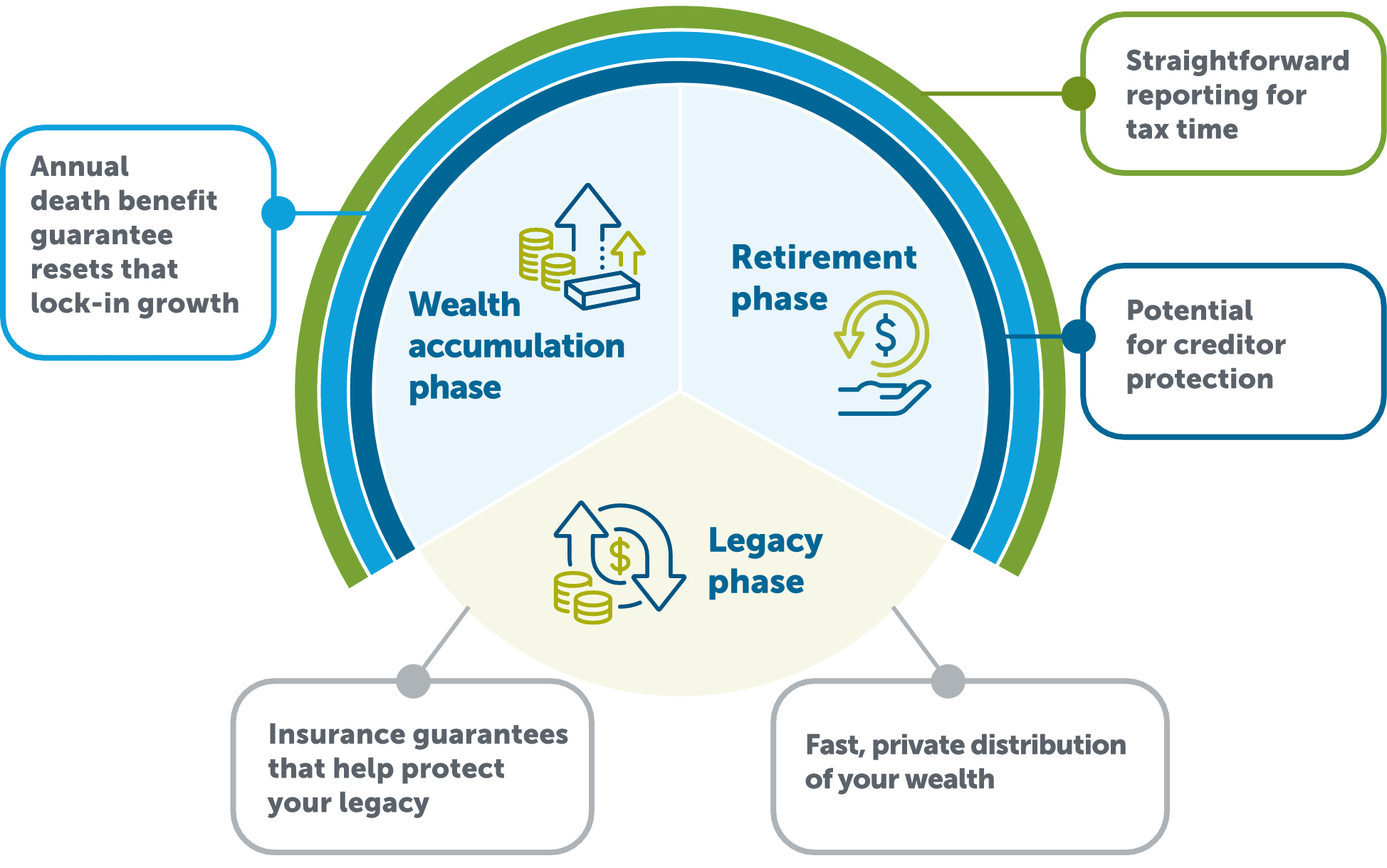

Whether your life’s goal is building wealth, having income for retirement or protecting your loved ones, Empire Life segregated funds have the choice and guarantees you need to help meet your financial goals for today and in the future.

Choose from our wide range of investment options to build and adjust your wealth plans as your needs evolve.

Just like any regular investment, you can start enjoying the fruits of your labour and begin withdrawing funds to support your retirement.

In the legacy phase, segregated funds provide fast and efficient distribution of your accumulated wealth to any designated beneficiaries.

1The maturity and death benefit guarantees are reduced proportionately for any withdrawals.

A description of the key features of the individual variable insurance contract is contained in the Information Folder for the product being considered. Any amount that is allocated to a Segregated Fund is invested at the risk of the contract owner and may increase or decrease in value.

© Registered trademark of The Empire Life Insurance Company. Policies are issued by The Empire Life Insurance Company. All rights reserved – 2021.